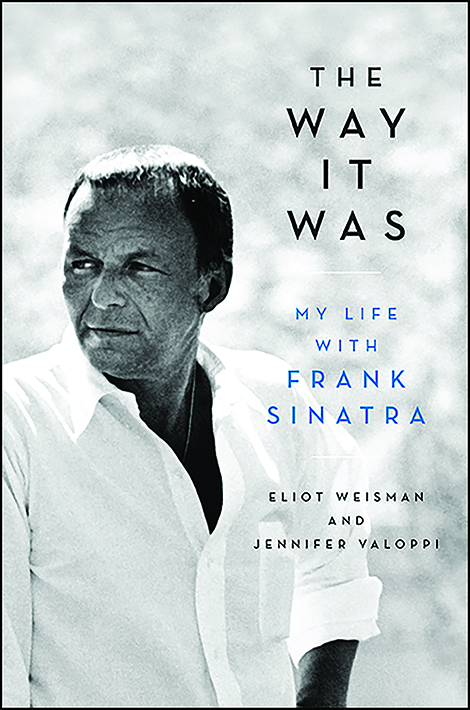

‘The Way it Was: My Life with Frank Sinatra’

If there’s a Frank Sinatra fan on your gift list this season, Eliot Weisman has a book for them.

Eliot Weisman served as a manager, confidant, and advisor to some of the biggest names in entertainment in the 20th century – Liza Minnelli, Sammy Davis Jr., Don Rickles, Steve Lawrence, Eydie Gorme, Joan Rivers – and the “Chairman of the Board,†legendary singer Frank Sinatra.

In Weisman’s new book, “The Way it Was: My Life with Frank Sinatra†(Hachette Books, 320 pages, $27), he chronicles his years as Sinatra’s longtime manager to Sinatra through original photos and personal anecdotes and revelations. For instance:

- Sinatra and Weisman losing their cool in negotiations with Donald Trump for the grand opening of Trump’s Taj Mahal casino in Atlantic City;

- The backstory of the infamous photograph of Sinatra with mafia leaders and Weisman’s futile attempts to keep it from the press.

- The mystery woman who threatened to throw the entire estate into chaos when Sinatra died about 20 years ago.

- The relationship between Sinatra and Jackie Kennedy

- How seriously Sinatra and his team took the job of security, from carrying an Uzi on his private jet to keeping a pistol hidden in his custom boots while on stage.

Weisman also relates his own personal journey, from Wharton Business School to a prison stint that left him broke and stripped of his professional licenses, to getting a second shot at a career as a high-powered manager by working with Sinatra.